Dear Traders,

The market continues to provide some clean technical setups, with several stocks testing key levels and breakouts. Keep an eye on retests, volume confirmations, and daily closes to validate the next moves.

FUBO saw a strong move today, popping above the volume shelf and closing exactly even on the day. There’s not much volume resistance above, so if we can get a daily close above $4.15, it would set up well for continued momentum into the rest of the week.

PLTR continues to defy expectations, breaking above the 2.618 Fibonacci extension today. A close above this level now technically triggers the next upside target at 3.618 Fib extension ($140.81). I’ve seen plenty of skepticism about this move, which suggests a lot of shorts may still be trapped, increasing the potential for a continued squeeze.

Not a bad session overall—MACD has crossed bullish on the daily candle chart, and price managed to hold at the volume shelf. After going green to red and back to green, CELH is maintaining support. There’s a large volume gap above, with an initial upside target at $24.83, which remains in play.

AMZN printed a hammer candle at the S/R flip zone, which is significant. Although price dipped below this zone intraday, it failed to close below it—a key reason why following daily closes for invalidation is important. Given that it held, this setup offers a solid risk/reward opportunity for an upside move toward the gap fill at $236.01.

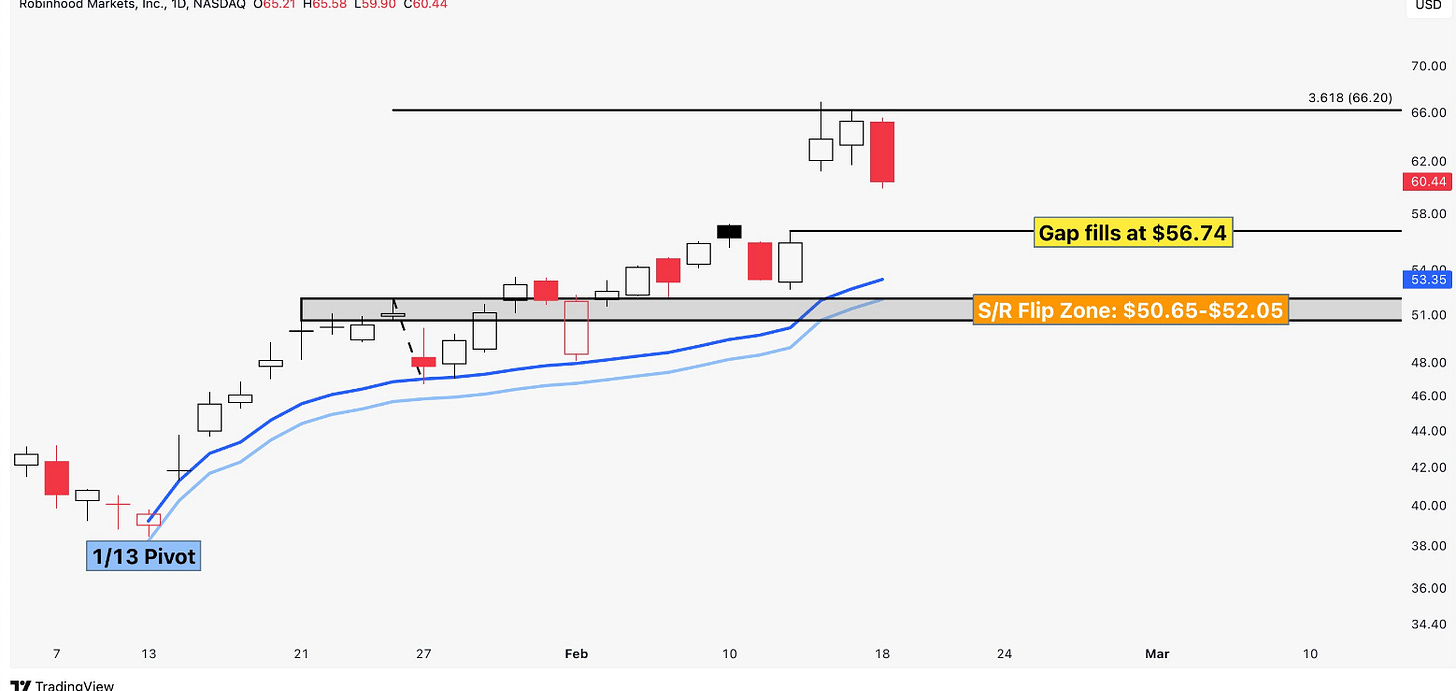

HOOD faced a hard rejection at the 3.618 Fib extension ($66.20)—a level we were watching as resistance last week. Today’s tweezer top formation, combined with a strong downside reversal, suggests weakness. Based on this candle structure, the gap below at $56.74 could fill at some point this week.

COIN filled the downside gap at $263, which acted as short-term support today. The stock remains highly rangebound, but as long as it holds above the 9/6 pivot VWAP zone, the status quo remains intact. This pivot VWAP has provided key support since September, and losing it would change the near-term trend.

SMH technically closed above previous resistance, which now becomes potential support. If price can hold above $254.47, it would validate the breakout and confirm the gap fill target at $260.62.

• As always, a retest of former resistance turning into support is the default expectation before the next move higher. This doesn’t mean a pullback is required, but risk/reward is better on a pullback retest vs. chasing the breakout.

#Bitcoin

Something wild is developing on Bitcoin’s chart.

• The left chart has been a key watch for weeks,

• The right chart shows an anchored VWAP pinch, with the top of the pinch aligning almost exactly with the same price—suggesting a double trigger at $100,500.

This could be a major inflection point, so keep an eye on Bitcoin’s reaction at this level.

Disclaimer:

My insights here are personal and intended for educational purposes only. Trading carries significant risk, and no strategy guarantees success. Please seek advice from a financial advisor before trading. By engaging with this content, you acknowledge that you're responsible for your investment decisions.

~ Az Heidens